I grant that ISIS may be more knowledgeable about the “enslaving, imperialist dollar” than it appears, given that they feature a clip from former Rep. Ron Paul in their latest propaganda video about bringing down our currency and replacing it with ISIS’ gold money, but one gets the sense that the jihadists are unaware of The Fed’s historical record.

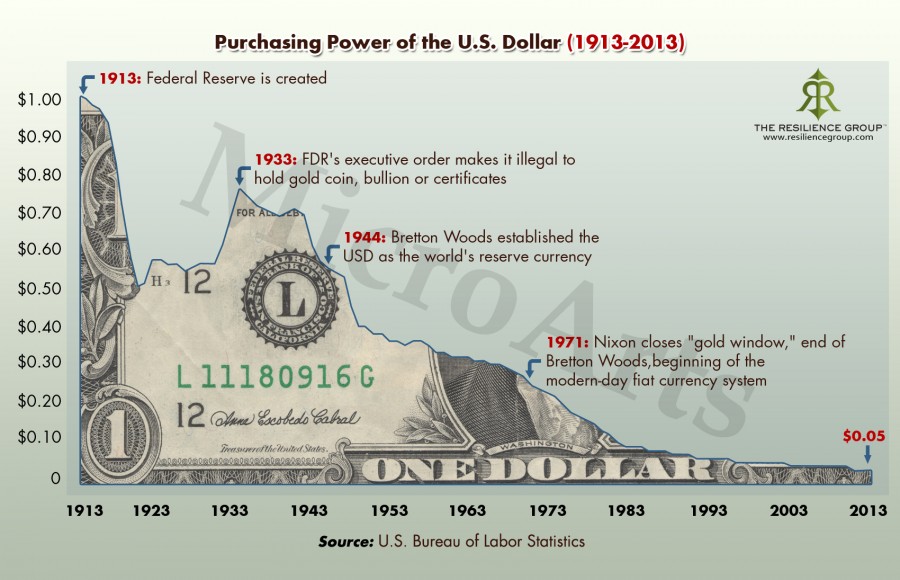

Namely, since its founding in 1913, The Fed has utterly debauched the dollar.

Had ISIS consulted the handy US Inflation Calculator, they would have learned that it takes roughly $2,400 today to purchase what would have cost $100 at the inception of the Fed.